Tokenomics in The Friendship Pod Network

The advantage of developing your own token economy is that nobody can tell you how it should go. Your only real boss is the market and your three most critical partners in business. Cash flow, cash flow, and cash flow.

When developing a platform around crypto, you sometimes wish you had a boss. Someone to just tell you what to do rather than you having to think through all the variables yourself, then having to go through the frustration of putting it all together, and of course owning the failures.

Every step into the unknown leaves a trail of wasted money, expended energy you will never get back, and sacrifice of time and resources beyond compare. Of course, this is the typical entrepreneurial path of any pioneer, it’s just the unforgiving and permanent nature of the blockchain that makes it all the more intrepid.

Tokenomics come about as a decision point when you are launching a new token for either a community or a network of communities, such as we are doing.

When we created the $4DStory token, we had to answer that all too difficult question of the quantity at which to set the Max Supply. The biggest factor in our situation that affected it was the fact that we were wanting to use the token for a number of different things. From governance and gamification rewards to a store of value and a way to generate funding for our venture.

Each of these different strategies demands individual tokenomic approaches, further dependent on the number of members participating. A factor that’s never consistent or predictable.

Again, this is where you wish someone would just tell you what to do and save you the grief of making that decision yourself.

But when you step into the abyss and live to fight another day… you learn.

When making tokenomic decisions, you find yourself comparing each subsequent decision against the strategy you settled upon. This is critical to understand because it affects the building of your community in two ways. First, it removes the angst around the decision knowing you will be able to adjust for it, as you move along. Second, it becomes a sort of keel by which to steer your community because the token tends to be a defining factor in everything you do.

If the token is intended as a store of value but you also use it to reward members through a gamification strategy, then you could possibly find yourself saturating the distribution of the token, softening its value across the total supply.

As a gamification token, depending on the parameters of your game, you could end up rewarding all your tokens and not have a supply left for the liquidity pool.

Using your tokens as a governance token while also gamifying your content and at the same time making them available for purchase through exchanges means your project is being governed mostly by those who are most engaged or invested in your community. But with this advantage comes the obvious disparity of your token having multiple places to flow to and multiple forces that are acting on it.

Once the max supply is set, it cannot be changed. This is what makes it so difficult to determine, though it also allows a token to increase in value when acting like a store of value. The pressure you put against this max supply while it's growing is the very element that increases its value.

In order to mitigate and normalize potential fluctuations we need to have a few things in place before we surmise a max supply limit.

We need a way to perpetuate the community for the long term. Not just a three-year projection, but a solid execution of possibilities for a lifetime.

This perpetuity exists in the form of value being formulaically increased by adding real value to the community, based on their theme and collective persona.

There also needs to be a gating mechanism to allow the membership to grow in alignment with your supply.

Not only does the supply matter, but the rate at which you can mint new tokens also matters. A slower rate of membership growth could potentially be the very thing you need to maintain in order to keep token holders comfortable that their token is increasing in value while the supply is also increasing.

It’s an ongoing balancing act you cannot predict. You have to build your community in such a way that you can react to these variables as they fluctuate and do so ethically.

You can always offer a means to burn tokens as well, though I am not in favor of this because it diminishes the supply overall. I would prefer to add more value to the existing tokens and allow the token price to be a final determinant of how we affect the supply.

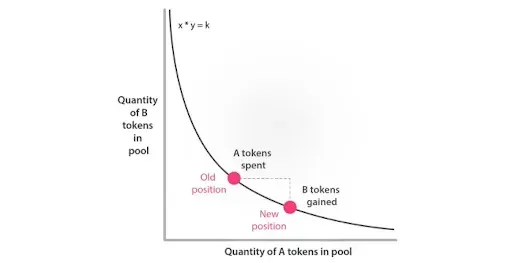

At the end of the day, there is one mitigating factor that will help you hold water in your tokenomics boat. When you establish a liquidity pool for your token, you set the min and max prices. What this means is once you establish a price for the token and the min/ max, these min/ max values become walls against which the token trades against.

The more tokens someone trades for or buys, the more expensive the token becomes. The token price will go to infinity as the liquidity pool approaches empty, keeping it from ever emptying completely. The crypto you acquire during these transactions can be used to reload the liquidity pool with new tokens.

From the Uniswap.org DEX website: “Uniswap uses an automated market maker system. This alternative method for adjusting the price of an asset based on its supply and demand uses a long-standing mathematical equation. It works by increasing and decreasing the price of a coin depending on the ratio of how many coins there are in the respective pool.”

This means you can use your liquidity pool to soft-regulate the token price by adding tokens or buying up tokens in order to affect its stability. Arbitragers buy tokens in one exchange and sell them in another for a profit, which helps regulate the token around market norms. So in concert with these bots, monitoring your liquidity pool can help reinforce a more stable token.

There are a lot of different variables affecting the tokenomics of a token community. The absolute best way to stay ahead of this curve and ensure your supply is valued at its highest level is to first set a minting schedule that acts as a primary regulator.

We use Valorize for token creation. Here is their approach to understanding Token Supply Mechanics:

“Tokenized projects often do not have their total supply in circulation at launch date but rather rely on a schedule for inflation that is predictable and governed on-chain. At Valorize, we developed the Timed Mint Token smart contract which provides an administrator address and a minter address to increase the supply according to certain parameters. This contract allows users to set a minting schedule and set the total token supply when deploying the token on the blockchain. Once deployed, there is a limit to what can be altered. The mint cap, for example, provides the option of a maximum token supply, or ignores this requirement to have an unlimited supply. Consequently, the smart contract allows tokens to be minted until the circulating supply reaches the supply cap.

Users that deploy the smart contract are time-limited as to the ability to mint new tokens. After creation, the user is required to set a time delay. The time delay only allows minting when the set time has passed.

Afterwards, the same time delay will be automatically set until the total supply cap has been reached.

Each minting period has a cap on the number of tokens that can be minted. In this way, anyone can calculate and verify the circulating supply into the future. All in all, implementation of the Timed Mint Token contract allows a user-defined number of tokens, that adhere to the ERC20 standard, to be minted under time-dependent conditions until the pre-specified total supply cap is in circulation. Using these functionalities will form the basis of tokenomics and will add more depth to community tokenization.”

As we see here, once the token supply is established the next step is to determine how often your tokens can be minted. If you were to mint the entire supply at once, you could potentially saturate your token and disrupt the fragile balance between supply and demand. By regulating your minting schedule, you not only give investors confidence that you won’t burn out the supply overnight, dumping their value but it also acts as a foundational way to stabilize the price.

Friendship Pods are token communities, participating in a unified network, sharing the $4DStory token. This means that across multiple token communities all using the $4DStory token the variables are significantly compounded. But it also means that the more members we have contributing to each community, the more forward momentum the token has.

This forward momentum is key to providing token stability for growth. If momentum is positive and the force behind it is constant, then 80% of your tokenomic woes can be easily mitigated. It’s when the propensity for value begins to decline or stall, that the token starts to lose value. This is when NFT projects will do their disappearing act and rug-pull the project, cashing out and disappearing into thin digital air.

A Friendship Pod Community, however, cannot just pull the rug and run. They are physically and humanly represented across the membership. The goods and services tied to these communities make it impossible to rug pull and run.

A tool we’ve developed in order to help us forecast a variety of situations around these tokens is called the LIFT formula.

LIFT isn't an acrostic… it’s a result that comes from the laws of aerodynamics in flight.

The forces that produce lift in an aircraft wing are:

- Thrust

- Drag

- Weight

When an airplane is flying straight and level at a constant speed, the lift it produces balances its weight, and the thrust it produces balances its drag. The lift equation states that lift L is equal to the lift coefficient Cl times the density r times half of the velocity V squared times the wing area A. For given air conditions, shape, and inclination of the object, we have to determine a value for Cl to determine the lift.

Think of the airplane wing as value, trying to fly in a gulf stream of tokenization. The goal is to lift that wing into the air or to lift the value of the token within a particular ecosystem/ community.

The coefficient is the most liquid variable in the formula. For example, when using the Lift formula to share dividends between creators or contributors, we create a contribution factor out of the variables that define creator contributions, such as quantity, quality, mean time between contributions, etc.

The Lift formula can be used in various ways, anytime we are trying to predict variables that are not constant and are acted upon by multiple forces.

The formula will not deliver exact results and oftentimes has to be tweaked and played with to produce a clear result you can use… but what it does do well is to connect an otherwise esoteric concept to something that we can relate to so as to provide clarity and support in decision-making.

Understanding the dynamics between token worth, membership levels, community value, and future expectations of your platform will give you the ability to govern your communities and grow a network as efficiently as needed. It’s also a lot of fun because it’s like playing a real-life game of RISK but without all the battles and wars.

By joining the Friendship Pod Network, as opposed to building a standalone token community, you are joining an already stabilized network of variables.

We invite you to engage us in a conversation about what we can do for you and your Web3 community's dreams and visions.